The Disputes Tribunal

The Disputes Tribunal: what it is, what it covers

What is the Disputes Tribunal?

The Disputes Tribunal is an independent forum for resolving legal issues. Compared to going to court, the Disputes Tribunal is a cheaper, quicker, and less formal way to deal with a dispute.

There aren’t any judges in the Disputes Tribunal, and you can’t have a lawyer represent you. While the law is important, the Tribunal also looks at what is fair and just in the circumstances.

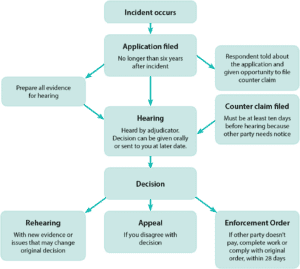

If you are involved in a Disputes Tribunal claim, you’ll be invited to a hearing, which is run by an impartial referee. Referees are appointed because of their personal qualities, knowledge and experience, and many referees have training and experience in dispute resolution and the law. At the hearing, the referee works with the people on both sides of the dispute to see if they can reach an agreement. If they cannot agree, the referee can make a decision about how to resolve the dispute. In both cases, the decision is legally binding.

What types of disputes can I take to the Disputes Tribunal?

Disputes Tribunal Act 1988, ss 10, 16

The Disputes Tribunal can help with disputes on most interpersonal and consumer issues – for example, if someone owes you money but they’re refusing to pay it, or if you hired someone to do a job and they didn’t complete it. There are some topics that the Disputes Tribunal can’t hear. This is usually because there is a different, specialised Tribunal for that issue.

The Disputes Tribunal might not be the right place for:

- Tenancy issues between landlords and tenants – these are covered by the Tenancy Tribunal

- Disputes at work – these are covered by the Employment Relations Authority

- Disputes with a registered vehicle trader – these can also be heard in the Motor Vehicle Disputes Tribunal instead

- Disputes about copyright – these can be covered by the Copyright Tribunal

- Disputes with ACC – these are covered by the Accident Compensation Appeals District Court Registry

- Disputes about benefits – these are covered by the Social Security Appeal Authority

- Disputes about rates or taxes – these are covered by the Taxation Review Authority

- Disputes about leaky homes – these are covered by the Weathertight Homes Tribunal

- Disputes about wills – these are covered by the Family Court

- Disputes about care arrangements or child support – these are covered by the Family Court

- Disputes about the division of relationship property, if you’re married, in a civil union, or you’ve been in a de facto relationship for three years or more – these are covered by the Family Court

- Debt collection – if a debt is undisputed (see: “Step 6”).

You also can’t bring a claim in the Disputes Tribunal if you’ve already come to a settlement agreement about the issue. Often, a settlement agreement will state that you’ve come to a “full and final settlement,” which means the issue can’t be re-opened or re-litigated.

If you’re not sure if your issue can be heard by the Disputes Tribunal, it’s worth applying anyway. If your issue is covered by a different Tribunal, they will redirect your application to the right place.

Note: Sometimes contracts will try to include a clause saying that you can’t use the Disputes Tribunal. This is generally unenforceable – you can’t contract out of your right to go to the Disputes Tribunal. If your dispute isn’t in the above list, and if you haven’t already come to and finalised a settlement agreement about your dispute, you should be able to go to the Disputes Tribunal.

How large a claim can I take to the Disputes Tribunal?

Disputes Tribunal Act 1988, ss 10(1A), 10(3)

The maximum amount of money you can ask for (“claim”) in the Disputes Tribunal is $30,000. This limit is different for other tribunals (for example, the Motor Vehicle Tribunal has a higher limit).

What if my claim is for more than $30,000?

If your claim is for more than $30,000 you will need to go to the District Court.

It’s technically possible to claim for $30,000 (or less) in the Disputes Tribunal and then, if you and the other side both agree, come to a settlement agreement of more than $30,000. But, if the final decision is made by the referee, the order cannot be for more than $30,000.

Increased limits for Disputes Tribunal claims from 2026

Disputes Tribunal Amendment Act 2025

In October 2025, Parliament passed legislation to increase the limit for Disputes Tribunal claims from $30,000 to $60,000. The increased $60,000 limit will come into effect on 26 January 2026. Until that date, the limit remains $30,000.

Did this answer your question?